Hello to the new 20 subscribers, happy to have you around, you may not know it but the principal editorial line of my newsletter so far was Web3 (Blockchain, cryptocurrencies, NFTs, Artificial intelligence…).

However, I made a decision recently: Web3 is not my defining factor, I write to express my soul, thus I won't talk exclusively about Web3.

This is why instead of creating a new newsletter i am going to divide this one in 2 :

Monday → Whatever my soul dictates me to express, life experience, learnings I want to share, books recommendation, this will be my free space which I hope will provide valuable insights.

Wednesday → Web 3 focus. For the last 3 weeks (this one included), I have shared my crypto thesis, why I believe in the ecosystem, what are the different industries and sub industries to follow, the impact on the ‘real’ world, and how you could benefit from it.

I believe that I found a way to be fully content with my writings, and I would love to receive your feedback anytime ! I am more than open to critics.

Now before you read the following you may want to reread the two previous parts :

Crypto thesis Part 3

The original purpose of Bitcoin is to transfer money from a peer to peer, the original purpose of Ethereum is to dematerialize the transfer of any entity, thus both are exposed to one limit : Scalability.

I am sure many of you already heard the term but to make it more concise it means: increase the distribution of the entity to a more global market without changing its core features.

In our example scalability takes the form of more transactions performed on the network per second.

Easy would you say, lets just optimize those networks to have more transactions per second, hallelujah !

Wait a second, unfortunately optimizing scalability is always done at the expense of one of the two following :

→ Less security

→ Less decentralization

Which are both embedded characteristics of ethereum and bitcoin, welcome to the blockchain trilema..

The Ethereum foundation states that they will solve the trilema for the Ethereum blockchain in the new form of ether, that may take up to 10 years to be operational.

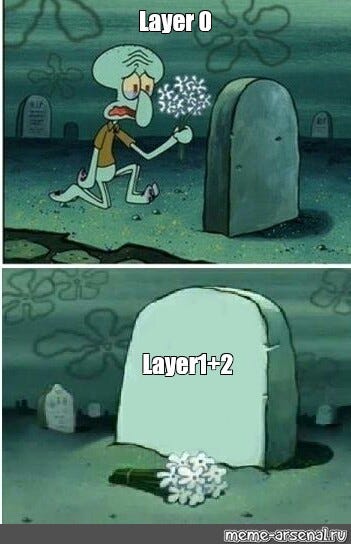

In the meantime the current solution found is caller Layer two. Before losing you, let me explain what layer 1 is.

You see your house ? Well consider layer 1 as the foundation, it’s the infrastructure that allows the cryptocurrency to exist, the main blockchain.

You see the walls and roof of your house ? That’s the layer two’s, it’s the facilities that protect and enhance the characteristics of the cryptocurrency without changing the foundation.

Layer two solutions increase the efficiency and scalability, it allows to do more with less.

Explore layer two with Ethereum:

Ethereum is the main network, the one that defines the rules of the ecosystem, as explained in last week news-letter it allows anyone to come build on top of its blockchain decentralized applications.

Layer two brings new features, they have their network but any transaction gets validated and finalized on the ethereum blockchain.

Why do we need to understand how they work ?

As i told you ethereum may not solve the trilemma by itself, currently we’ve reached many time full capacity on the mainnet, which has led transaction fees to rise and even exceeds the price of your transaction:

→ Wish to transfer 50$ worth of ether → Fees 70$ of ether..

Layer two’s by being off chains solutions reduces bottleneck, they can :

→ Lower fees, they bundle a group of transactions into one thus saving space on the original blockchain.

→ More utility, they focus on improving + expanding scope of applications.

You see, the original blockchain performs different actions, each of them can be performed by a layer 2 to enable more scalability, but some must stay in the main network for security and decentralization purposes…

Personally I don't believe in the long run role of layer two’s, ethereum will succeed in its mission to solve the trilemma, however in the meantime they will play an important role in participating in the resolution.

This is why I believe any informed crypto investor should get to know them and how he could allocate a portion of his portfolios to such assets for a short period of time.

What takes 10 years to change in another industry only takes 1 in Web3. This is why your investment thesis will constantly evolve and have different time lapse.

Your goal is not to be right, but to make money. Paradoxal bets can happen and can be very profitable.

Thanks for reading me.

Don’t hesitate to send me private messages if you have a specific question, a feedback or a topic you would want me to write on.

In the meantime you’re half way through your week, keep pushing.